At Zephyr Insurance, we value your trust and want to keep you informed about an upcoming adjustment to your insurance rate. Due to various factors, the insurance industry is currently facing a notable increase in reinsurance costs, which covers insurance for insurance companies. Consequently, you will notice a rate adjustment when your policy is renewed this year. We want to assure you that we remain committed to providing you with excellent protection and service. Soon, you will receive a detailed renewal packet outlining the changes. We encourage you to review it thoroughly and reach out to us with any questions or concerns you may have. Your loyalty means everything to us, and we remain dedicated to providing excellent protection and service.

Our Hawaii Insurance Market

What is reinsurance?

You may hear the term reinsurance in connection with insurance rates and changes. Reinsurance is a tool used by insurance companies to transfer some of their risk to other companies. It’s essentially insurance for insurance companies. While increases in the cost of reinsurance are the main driver behind your current rate increase, other factors play a part as well.

Insurance premiums are impacted by economic, political, climatic, and other factors. High interest rates, falling investment returns and the frequency and severity of losses have all contributed to the hardened reinsurance market we face today. Most notably, increased frequency and severity of catastrophic events worldwide continue to negatively impact the cost of reinsurance for carriers.

Rising reinsurance costs have made it necessary for insurers to adjust rates which is subject to regulatory review. This approval process can take months and sometimes years. Such delays can cause insurance carriers to restrict writing new policies, tighten underwriting and coverage options, or in some cases not offer coverage at all. Historically, Hawaii has benefitted from some of the most affordable home insurance rates in the U.S. However, in addition to the above, Inflation and increases in home valuations and construction costs in Hawaii have contributed to higher insurance premiums.

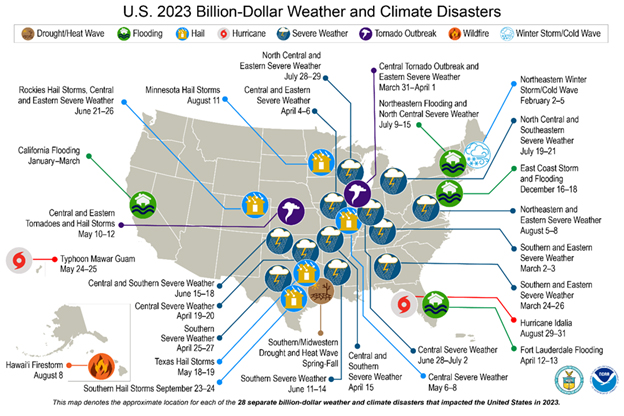

The picture below highlights the billion-dollar weather and climate disasters in 2023 that have influenced the rise in cost for reinsurance.

Considering these trends, the insurance industry is dedicated to understanding and mitigating loss. We encourage customers to reach out to their agents to discuss preventative measures they can take to cost-effectively protect their assets. Please visit the Potential Savings Tab to learn more about some of these measures that can possibly provide premium savings.

What saving options do I have?

Zephyr customers can realize an average savings of 10-15% on their policies by adding wind mitigation devices to their homes. When the following devices are added to a home, they will not only increase its resiliency but may provide substantial discounts on the insureds Hurricane Policy:

- Roof to wall connections

- Wall to foundation connections

- Opening protections like:

- Impact resistant windows

- Hurricane rated doors

- Storm shutters

For a more detailed examples, please click on this link: Simpson Strong-Tie

Coverage Changes

Zephyr customers may be able to lower their premiums by adjusting the deductible and coverage amounts on their policies. Any discussion about these changes should be handled with their agent. Customers should also consult any lenders on the policy to make sure they comply with the terms of their mortgage.

Please contact your agent to see what credits are eligible on your policy.

Are payment plans available?

At Zephyr, we offer different payment plan options to help you manage the payments of your premium.

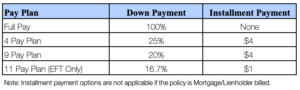

Here are our options: